According to realestate.com.au in early February, search volumes (people looking at homes to buy) rose for three consecutive weeks and are now an impressive 49.1 per cent higher than they were at this time last year. This seems remarkable to us as January 2020 was also extremely busy.

This is even stronger here in New South Wales where along with Western Australia and the ACT, search volume is up over 50%. In fact, Tasmania and Northern Territory are the only states in which buyer search volumes weren’t at historic highs.

When the global coronavirus pandemic hit Australia in mid-March 2020, the outlook for the property market was dire. But despite initial fears the housing market could drop by as much as 30% during the health crisis, property prices showed resilience over 2020.

Prices in the majority of Australian suburbs actually grew in 2020, despite prolonged lockdowns in some parts of the country.

The big story however was not the falling market (or lack of). 2020 will be remembered as the year that buyer demands changed. Lifestyle suburbs were among those to see the biggest price growth in 2020, suggesting a shift away from city living during the pandemic.

People have been moving out of Sydney and other capitals for a quieter life. The ability to be able to work remotely has been the huge catalyst for this. Acceptance of Zoom meetings and cultural shifts in the workplace mean that many workers will not have to return to the office five days a week. This opens up the opportunity for workers to live further away from the office in a location they want.

Not surprisingly, regional NSW is now outperforming Sydney’s property market. Sydney’s median dwelling value, based on both unit and house sales, was up 4.5 per cent year-on-year to a median of $1,012,778. While the median across the rest of the state climbed 8.8 per cent to $546,879 over the year to December 2020.

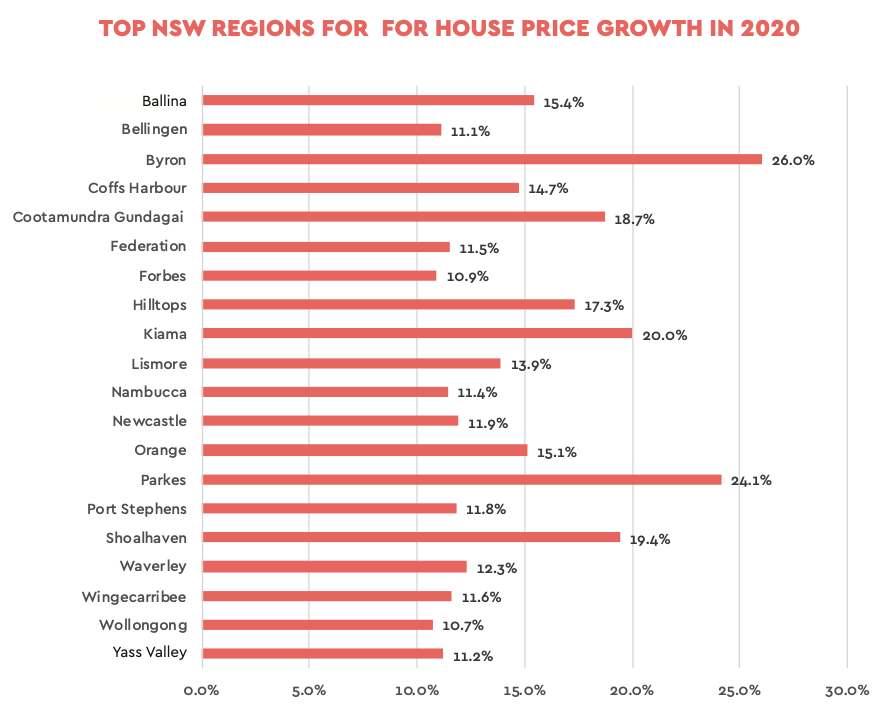

Newcastle house prices are up 11.9% during 2020. Whilst impressive, our numbers are only moderate compared to some other areas around the state

House prices in Byron Bay saw the largest jump, with the median climbing a whopping 26 per cent to $1.15 million. It was followed by Parkes in the state’s central west and Kiama, on the south coast, which saw median prices climb by 24.1 per cent to $335,000 and 20 per cent to $1.02 million, respectively.

In fact, there were 23 local government areas which recorded double-digit percentage increases, with the coastal council areas of Coffs Harbour, Ballina and Shoalhaven, as well as the inland councils of Orange, Cootamundra and Wingecarribee — covering the Southern Highlands — among the strongest performing markets.

We think there is a pretty good chance this migration is yet to peak. It has been a year since the start of the pandemic. Many families have already made the move. But we believe this will continue for some time to come.

Newcastle has always been a bit of a relocation city. We are uniquely placed so people can work remotely but still visit the big smoke randomly for work as well as visiting family. Moving to Broken Hill or Nambucca Heads whilst idyllic doesn't offer the same benefits.

It has not been smooth sailing for all property owners though. The closure of our borders during the health crisis has led to a major reduction in international arrivals, particularly overseas students who make up a large cohort of inner-city renters. A subsequent oversupply of vacant rental units in major CBDs like Sydney and Melbourne has led to price falls in these areas.

New apartments have so far been fairly resilient in our CBD (so far at least), though this is more likely to be because these have been overwhelmingly sold to downsizers, rather than investors chasing student rents. On the other hand, it will be interesting to see how this affects our student areas like Birmingham Gardens and Jesmond.

We are pretty confident prices will continue to rise over the coming months. This is primarily due to record low interest rates which are unlikely to change soon. These are encouraging buyers to take on larger debt levels. They also encourage investors into the market. Investor activity distorts the market either positively or negatively as we saw in 2018 when the government through APRA squeezed investors out of the market and prices subsequently fell. That seems like a long time ago now. Investors are back. And in a big way.

On our back page we have included all the top sale prices by suburb in 2020. These are the best of the best, not the average. There are some amazing results which help us agents establish new record prices. Creating record prices sets a new bar and helps buyers justify higher purchases. We are confident that next years list will feature many new records.